For-profit prisons

Geoffrey Rubin (Source: CPPIB websitehttp://www.cppib.com/en/who-we-are/leadership-overview/senior-team/)

This has to be the most unfortunate story pairing of the month — the journalistic equivalent of steak and white wine. Or Dr. Pepper. Or motor oil.

First, on 11 October, the Chronicle Herald‘s John DeMont (whose writing I frequently enjoy) wrote a puff-piece about Geoffrey Rubin, the chief strategist for the Canada Pension Plan Investment Board (or as DeMont would have it, “The man who will determine whether or not you have to eat dog food in old age.”)

Rubin, you’ll be fascinated to know, is tall and sturdy, carries the pressure of “running one of the world’s largest retirement funds” lightly, works out, eats in Korean restaurants, sleeps well and “quarterbacks” an investment fund that has grown from $60 billion to $370 billion in the past 20 years, half that growth thanks to the contributions of Canadians, half “attributable to picking the right stocks, bonds and real estate investments.”

He and his 1,600 co-workers have “one objective and one objective only,” according to DeMont, to “get the highest investment returns, period, without jeopardizing the fund’s ability to be around when we all retire.”

That was the steak. Now hold out your glass, here comes the motor oil:

The Guardian (in cooperation with the Documented news website) reported the very next day that the CPP investment board has put $5.9 million into Geo Group and CoreCivic, for-profit prison firms that are “profiting from Trump’s ‘zero-tolerance’ Mexico border policy.”

And boy, are they profiting. As Michael Sainato noted in the Observer in 2017:

The private prison industry has thrived under Trump. Shortly after the election, stocks soared for the two largest private prison corporations, GEO Group and CoreCivic. Trump’s Department of Justice reversed a plan to reduce the use of private prisons in February 2017, paving the way for new government contracts for the industry. In April 2017, the GEO Group received a $110 million government contract to build an immigrant detention center in Texas. The same month, the Immigration and Customs Enforcement (ICE) gave CoreCivic a contract extension on its 1,000 bed immigrant processing center in Houston, Texas. GEO Group has received $774 million in government contracts in 2017 so far, and the company’s stocks have continually increased in response. This week, Bank of America increased its ownership of the company’s stock by over 2500 percent due to favorable forecasts. CoreCivic has ongoing contracts with the Department of Homeland Security and Department of Justice worth several billion dollars. The stock price for both companies has increased over 100 percent since Trump was elected.

No wonder Rubin is sleeping well.

The CPP investment board’s response was that the holdings were “a tiny proportion of their fund” and were “from pooled indirect investments.”

First, I’m afraid that “$6 million is not a lot of money” argument is just not going to fly with this child of the ’70s. I KNOW $6 million is a lot of money. IT CAN BUILD A BIONIC MAN.

A guard at the Northwest Detention Center, a private facility owned and operated by the GEO Group, on contract from Immigration and Customs Enforcement. (Photo by Alex Stonehill via Seattle Globalist)

And second, how is “We’ve only invested $6 million in the morally bankrupt, corruption-plagued, for-profit detention industry” a defense?” It’s like saying, “Yes, I shot him. But only in the arm.” Surely any investment in a morally bankrupt and corruption-plagued industry is too much investment.

But wait, there’s another defense:

CPPIB’s objective is to seek a maximum rate of return without undue risk of loss. This singular goal means CPPIB does not screen out individual investments based on social, religious, economic or political criteria.

So…do they draw the line anywhere? Not at weapons manufacturers. The Guardian reports the CPPIB holds $18.7 million in the defense contractor General Dynamics and $36.8 million in the defense contractor Raytheon. Not at tobacco companies. The CPPIB holds $202 million in tobacco giant Philip Morris.

They probably invest in dog-food manufacturers too, just in case their returns aren’t all they should be.

But is it “religious” or “political” to oppose investing in a company that runs an immigration detention facility where detainees wait “weeks and months” to see a doctor? Where a dentist “dismissed the necessity of fillings, and suggested that detainees use string from their socks to floss?” Where guards told government inspectors removing the bed sheets from cells was not considered a “high priority” although three detainees had used their sheets to hang themselves? Because these are just some of the findings of what the Los Angeles Times called a “scathing” Department of Homeland security report into conditions at the US Immigration and Customs Enforcement (ICE) processing center in Adelanto, California — a detention center run by Geo.

I’m not naive, I know that regardless of how he carries it, Rubin is under immense pressure to ensure his fund returns 3.9% per annum and imposing some moral or social criteria would undoubtedly mean missing that target. Sadly, morally questionable investments pay. The kind of criteria the board uses is really down to us. Will we ever have the courage to change them?

Weed

Here’s a pairing I actually enjoyed this week:

The Cape Breton Post on October 17 takes the public pulse on the issue of cannabis legalization by asking a select group of 10 people “Prithee, good citizen, will thee partake in pot smoking?” (Okay, I’m exaggerating, but only a little, they asked, “Will you partake in pot smoking?”) All 10 said, “No.”

The Cape Breton Post on October 18 fills the front page with pictures and stories about people lining up to buy pot.

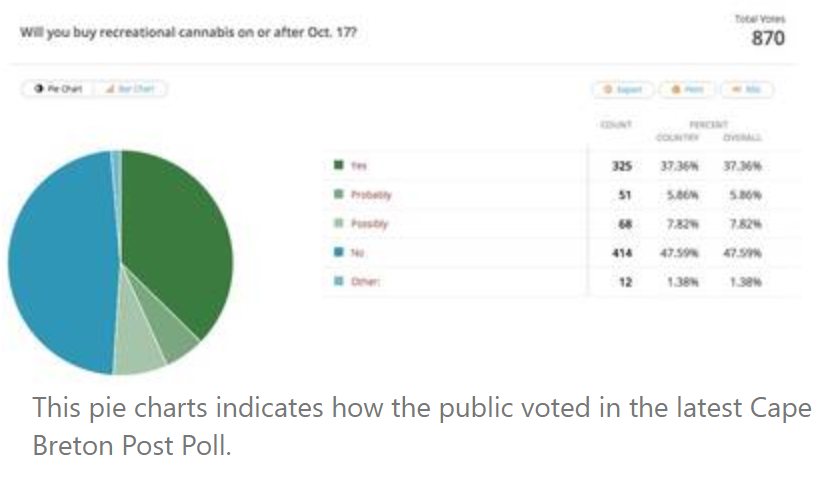

I also love this pie chart:

I think the caption should read: If you cannot read this pie chart, you have smoked too much pot.

Sur-prize!

I have to pick on the Post once more because this is too good to omit.

A spectator (you know who you are) pointed me to an October 18th Facebook post by CH Accounting & Tax Services:

WOW! Thanks so much to everyone who voted for us in the Reader’s Choice Awards

We truly appreciate all of your support!!!! We’re feeling the love and are thanking you all here as we’re not in any position to spend the $250 for the profile in the CB Post

LOVE YOU ALL & ALL OF YOUR SUPPORT!!!

Then, most amusingly, they posted the email from the Post‘s multimedia sales department which simultaneously announced the win — and hit the proud winner up for $250:

I get that the entire point of the Readers’ Choice edition is to make money by convincing the winners to buy ads, but making them also buy their own plaques is just plain cheap. And silly — because if CH Accounting and Tax is buying itself a plaque, why settle for “Cape Breton Post Readers Choice Award 2018?” Why not go for “Greatest Accountant of All-Time” or “Best Little Accountant in Nova Scotia” or “Stanley Cup of Accountancy 2018?”

Really, it’s just asking for trouble.

I mean, the publisher of an online weekly that wasn’t even nominated for a Cape Breton Post Readers’ Choice Award could get one made. Not that that would ever happen.

Ever.

Probably.

Shipping news

In my piece on Halterm this week I referenced the Israeli shipping firm ZIM.

I didn’t have room for any more illustrations in the article but I really wanted to add this one, because it suggests Sydney, too, is handling a few shipping containers:

Mind you, this particular shipping container wasn’t at the Port of Sydney or on the site of our future mega-container terminal and logistics zone — it was behind the Four Paws Pet Spa on Kings Road. I checked the ZIM website again, and sure enough, there it was on the firm’s Container Service Atlantic (ZCA) or AL7 route. I don’t know how I missed it before:

Savannah — Norfolk — New York — Halifax — Four Paws Pet Spa, 159 Kings Road, Sydney — Algeciras — Valencia — Barcelona — Piraeus — Izmir — Haifa — Ashdod — Mersin

Who knew?

A Farewell to Sears

I admit to feeling a twinge of regret at the news Sears had filed for bankruptcy (although, given the recent history of the one-time retailing giant, I wasn’t exactly surprised).

I remember the thrill of having something ordered from the catalog turn up at the front door. And the arrival (in September!) of the Sears Christmas “Wish Book” which always sparked the first battle of the Christmas season in our house. (Even though our mother had some nutty Peace-on-Earth-Goodwill-to-men idea that two — or more — children could read it at the same time. As if.)

Still, it seemed a little silly to be waxing nostalgic about a retailer that really seems to have signed its own death warrant with its questionable management decisions (like putting a Goldman Sachs portfolio manager in the CEO’s office). And then I heard this Wednesday’s episode of On the Media, (a podcast I have touted in this space before) “The Radical Catalog,” and it gave me a whole new perspective on Sears, thanks to guest Louis Hyman.

Hyman, an economic historian and professor at Cornell University, started a Twitter discussion about a “little-known bit of shopping history” by tweeting:

In my history of consumption class, I teach about #Sears, but what most people don’t know is just how radical the catalogue was in the era of #Jim Crow. #twitterstorians

— Louis Hyman (@louishyman) October 15, 2018

In a series of follow-up tweets, he explained that Sears allowed Black customers, during the Jim Crow era, to by-pass the local general store, where their ability to buy what they needed or wanted was at the mercy of the storekeeper:

Black families could buy without asking permission. Without waiting. Without being watched. With national (cheap) prices!

It’s a really interesting discussion. And as an added bonus, someone replying to Hyman’s tweet linked to another of my favorite podcasts — 99% Invisible — which just this September did a program on the Sears & Roebuck Mail Order Catalog, more precisely, on the house you could buy from the catalog.

It seems my twinge of regret was not unwarranted.

[signoff]